According to Dell’Oro Group, Fixed Wireless Access (FWA) has surged in recent years to support both residential and enterprise connectivity due to its ease of deployment along with the more widespread availability of 4G LTE and 5G Sub-6GHz networks. Preliminary findings suggest total FWA revenues, including RAN equipment, residential CPE, and enterprise router and gateway revenue remain on track to advance 7% in 2024, driven largely by residential subscriber growth in North America and India, as well as growing branch office connectivity more globally.

“Initially viewed as a way to monetize under-utilized spectrum, FWA has grown to become a major tool for connecting homes and businesses with broadband,” said Jeff Heynen, Vice President with the Dell’Oro Group. “What started in the U.S. is now expanding to India, Southeast Asia, Europe, and the Middle East, as mobile operators continue to expand their 5G-based FWA offerings to both residential and enterprise customers,” added Heynen.

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Total FWA equipment revenue for the 2023-2027 period have been revised upward by 17 percent, reflecting continued positive subscriber growth in North America and India.

- Long-term subscriber growth is expected to occur in emerging markets in Southeast Asia and MEA, due to upgrades to existing 3G and LTE networks and a need to connect subscribers economically.

- The Satellite Broadband market will also be a key enabler of broadband connectivity in emerging markets as well as rural markets where existing infrastructure either doesn’t exist or is cost-prohibitive to deploy. Subscriber growth will generally come from LEOS-based providers including Starlink, OneWeb, and Project Kuiper.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE (Residential and Enterprise) and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional subscriber forecasts for FWA and satellite broadband technologies, as well as Residential Gateway forecasts for satellite broadband deployments. To purchase this report, please contact us by email at dgsales@delloro.com.

…………………………………………………………………………………………………………………

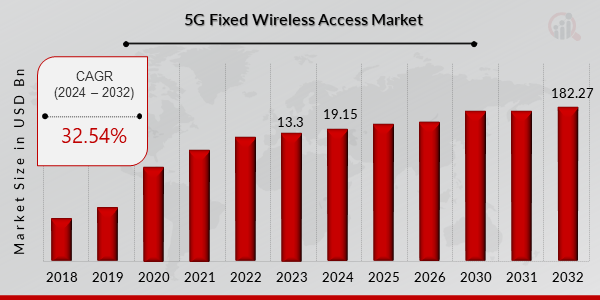

Separately, MRFR says the FWA market will be worth $182.27 Billion by 2032. Here’s a chart of 5G Fixed Wireless Access Market Growth:

FWA Growth Drivers:

Rising Demand for High-Speed Internet: With the increasing reliance on digital infrastructure and applications, there is a surging demand for high-speed and reliable internet connectivity. 5G FWA solutions offer ultra-fast broadband to underserved and remote areas, addressing connectivity gaps effectively.

Growing Adoption of IoT and Advanced Technologies: The proliferation of IoT devices and the need for seamless connectivity are driving the adoption of 5G FWA solutions. Additionally, advancements in mmWave technology enhance bandwidth efficiency, boosting market adoption.

Cost-Effective Alternative to Fiber Networks: 5G FWA provides a cost-efficient and rapid deployment option compared to traditional fiber-based internet, making it an attractive solution for internet service providers and enterprises.

References:

https://www.marketresearchfuture.com/reports/5g-fixed-wireless-access-market-7561

Latest Ericsson Mobility Report talks up 5G SA networks (?) and FWA (!)

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028